Systematic Investment Plans commonly known as SIP is the scheme of investment allowing a person to deposit a fixed amount in a mutual fund scheme. This enables the individual to invest small amounts of money on a weekly, monthly, quarterly, or yearly basis.

Owing to the instability of the market, it is never recommended to invest a large sum of money into equities. As a large sum investment will be kept off from your liquidity, it may cause you financial strain in difficult moments.

For instance, if you have taken a home loan or a personal loan while keeping a large chunk of money invested in the equities, it will only add pressure on your EMIs. Also, in a fluctuating market, it may happen that your returns reduce substantially even to the point of becoming negative.

However, with SIP, the invested funds can be monitored on the basis of their performance. This will enable one to analyse his further investments in the given mutual fund scheme. With periodic instalments, one can enumerate the savings to be used for investment.

With the help of a SIP calculator, one can presume an expected return on their savings. Using a SIP calculator is quite simple. All one needs to do is to put his periodic investment amount and the investment period. The SIP calculator will then calculate an approximate amount you will have as a return on your investment.

If you’re looking for a reliable SIP calculator, we suggest using the SIP calculator by Scripbox to know about your estimated returns on your investments.

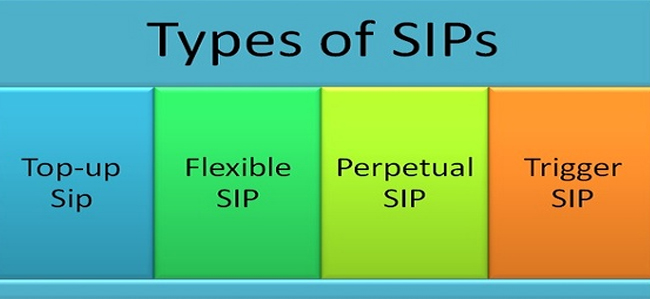

Different Types Of SIPs

There are basically four types of Simple Investment Plans. Let’s take a brief look at each of them:

Top-up SIP: Top-up SIP allows the benefit of increasing the investment amount periodically. This is helpful in investing in only those mutual funds which are performing better. Since the amount is increased periodically, one can make a large chunk of investment in a later period.

Flexible SIP: In this SIP, one is entitled to increase or decrease the investment amount on the basis of his cash flow. If an individual is running on the profit, he can invest more in the mutual fund scheme and if not, can even do away with a payment or two.

Perpetual SIP: When someone makes a mutual fund investment, he either does it with a timeline: be it a year, two or three. However, he also has the option to go along with no end date whatsoever. In this case, he will be allowed to redeem his funds as and when necessary.

Trigger SIP: In a trigger SIP facility, an investor can withdraw full or part of an amount when it reaches a pre mentioned trigger point. He can also switch to another investment scheme upon reaching this trigger point. This SIP helps in coping up with the unstable financial market.

Advantages Of SIP

1. Proper management of funds: Choosing a suitable SIP allows the individual to take advantage of investing funds in a disciplined manner. With a regulated payment based on fixed periods, an individual can accumulate his savings in the like manner.

2. Benefit in the long run: SIP is specially made to serve the investor in the long run. The profits to be accrued on the investment take a longer time because the investment amount is generally smaller in the initial period. That is why it is recommended to start investing early in SIP to reap its prime benefits. You can calculate your expected returns using a SIP calculator.

3. Minimal Risk: Many investors cannot afford to invest a lump sum at once. The large deposited amount also implies greater risk. SIP is helpful in this case. With a moderate investment and better than average returns, the investor has to go through a minimal risk only.

4. Flexibility in investment: Though it is recommended to invest in SIP keeping in mind the long term goals, this does not deprive an investor to withdraw the current amount on his convenience. With no mandatory fixed time, the investor is free to exit the plan any time.

5. Relaxation from taxation: One of the most lucrative factors of SIP is the tax relaxation it offers. An investor gets exemption or tax deduction in the investment sum, in the interest earnings and during the time of withdrawal of the investment funds.

6. Higher Returns: Compared to other deposit schemes like fixed deposits (FD), SIP returns are much better. It keeps adjusting with the fluctuating market and does not limit the income to a fixed rate of interest. However, it may also happen that there is a decrease in returns due to the financial market running on low. A SIP calculator significantly helps in estimating returns before you invest, so that you know exactly which investment will yield better returns.