5 Best Online Accounting & Bookkeeping Apps for Small Businesses

Several technologies and software have become practical tools to run any business. Accounting and bookkeeping are grown into all businesses’ operations. Well, financial bookkeeping is complicated and time-consuming. Business owners find it challenging enough to cover the basics—paying the bills and tracking incoming revenue—let alone answering critical questions: Are we profitable? Why or why not? Can we make the required tax payments? Should we invest in new equipment? Do we need to explore financing? Will we hit our budget numbers? Where can we cut expenses? Hence, business owners need accounting software that reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software.

So, to ease you find the resource that will work best for you, follow the list of the best online accounting & bookkeeping apps for small businesses:

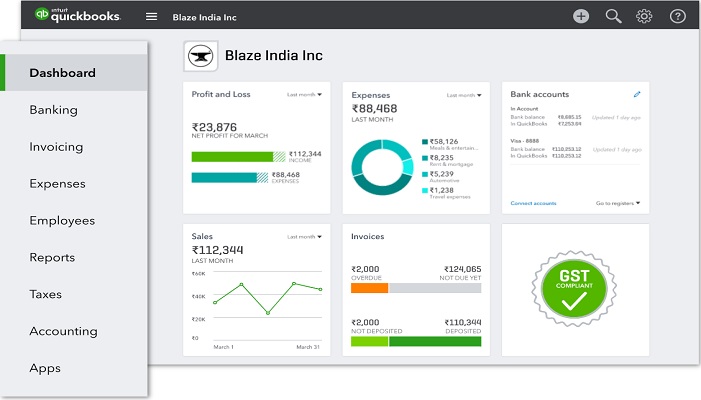

Intuit QuickBooks Online

QuickBooks is a convenient software for small businesses. SMBs can maintain accounting and tax data, create and send GST-ready invoices, determine tax liability, and instantly generate return reports. It also provides endless online training resources and forums to get support when needed. All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient. The software is cloud-based and can be operated through a web browser or through the mobile app.

Key Features:

- Scalable

- Commonly used by accounting professionals

- Integration with third-party applications

- Cloud-based

- Mobile app

Pricing:

30-day free trial, the four options for subscription plans include-

- Simple Start at $25 per month,

- Essentials at $40 per month,

- Plus at $70 per month,

- Advanced at $150 per month.

Xero

Xero is a powerful and all-in-one online accounting software solution. Run things smoothly, keep records tidy, and make compliance a breeze. It has features to collaborate with clients, manage your practice and make compliance simple. It allows the user to collaborate in real-time, in other words, to invite your advisor in and work together anywhere. This software holds a clean interface and also fully integrates with a third-party payroll service. Businesses can manage payment online from customers through Xero’s integration.

Key Features:

- Cloud-based

- Mobile app

- Payroll integration

- Third-party app marketplace

- Multi-currency accounting

- Simple inventory management

- Claims expenses

- Bank reconciliation

Pricing:

Three monthly subscription options and a full-service payroll add-on:

- Starter - $20 per month

- Standard- $30 per month

- Premium - $40 per month

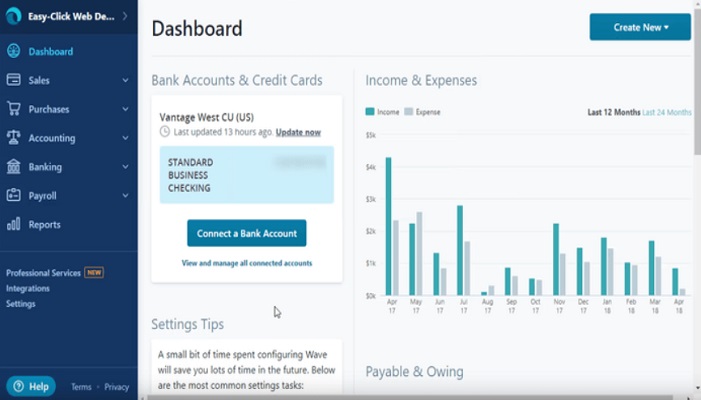

Wave

Wave is an ideal accounting software platform for a service-based small business that gives simple invoices and doesn’t require tracking inventory or running payroll. For freelancers or service-based businesses, Wave’s free features will include all of their accounting obligations. At year-end, accountants can pull the essential reports from Wave to prepare a business’ tax return. Everything is automated and in one perfect package.

Key Features:

- Free accounting, invoicing, and receipt scanning

- No transaction or billing limits

- Run multiple businesses in one account

- Unlimited number of users

- Mobile app

Pricing:

Free to use and offers two payroll plans as an add-on service.

- The first plan is $20 per month plus $6 per employee or contractor.

- The second plan is $35 per month plus $6 per employee or contractor.

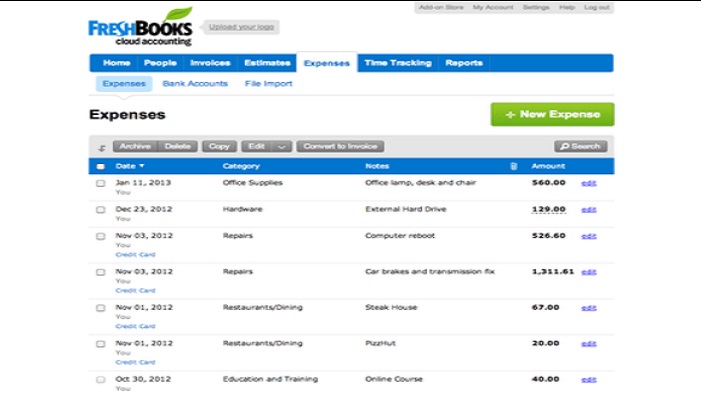

FreshBooks

FreshBooks is an elementary solution that prides itself on making small business accounting more efficient. As per its website, FreshBooks' software can support users save up to 46 hrs a year on filing for their taxes. It allows more customizations for invoicing. Its basic function is to send, receive, print, and pay invoices, but it can also take care of a business' basic bookkeeping necessitates as well.

The platform combines with many business applications and provides you with a single dashboard to manage your finances and accounting. Regular secure backups are involved, and a mobile app enables you to keep track of your business at all times.

Key Features:

- Cloud-based

- User-friendly interface

- Third-party app integration

- Affordable

- Advanced invoicing features

Pricing: Free trail for 30-Day and Starts at $4.50/month

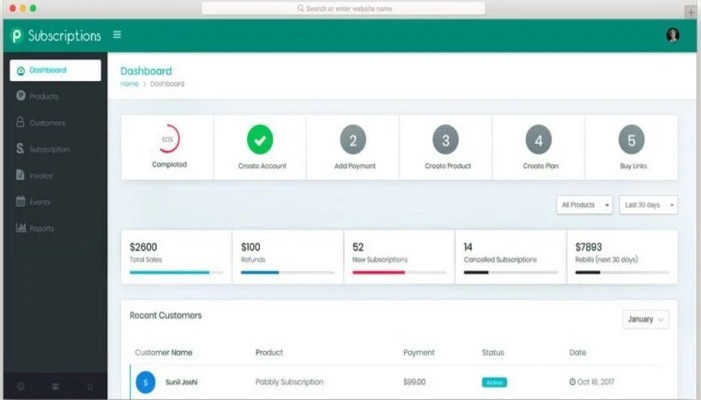

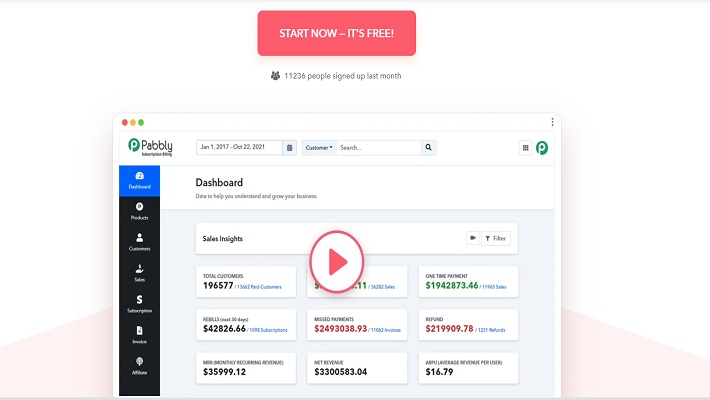

Pabbly

Pabbly Subscription Billing is a persisting and subscription management software for small to medium-sized businesses. It gives valuable real-time metrics on your monthly payments, revenue, net revenue, active customers, and new subscriptions. It also automates all your business workflows, customer communication, and invoice creation so you can concentrate on your business growth.

Key Features:

- Easy Invoicing

- Organize Expenses Effortlessly

- Insightful Time Tracking

- Seamlessly Collaborate on Projects

- Get Paid Faster

- Easy-To-Use Double-Entry Accounting

- Mobile App

Pricing: Starts at $9 per month